INFOLIA AI

Issue #25 • October 10, 2025 • 4 min read

Making AI accessible for everyday builders

The AI race shifted from algorithms to infrastructure—and China just won open source

👋 Hey there!

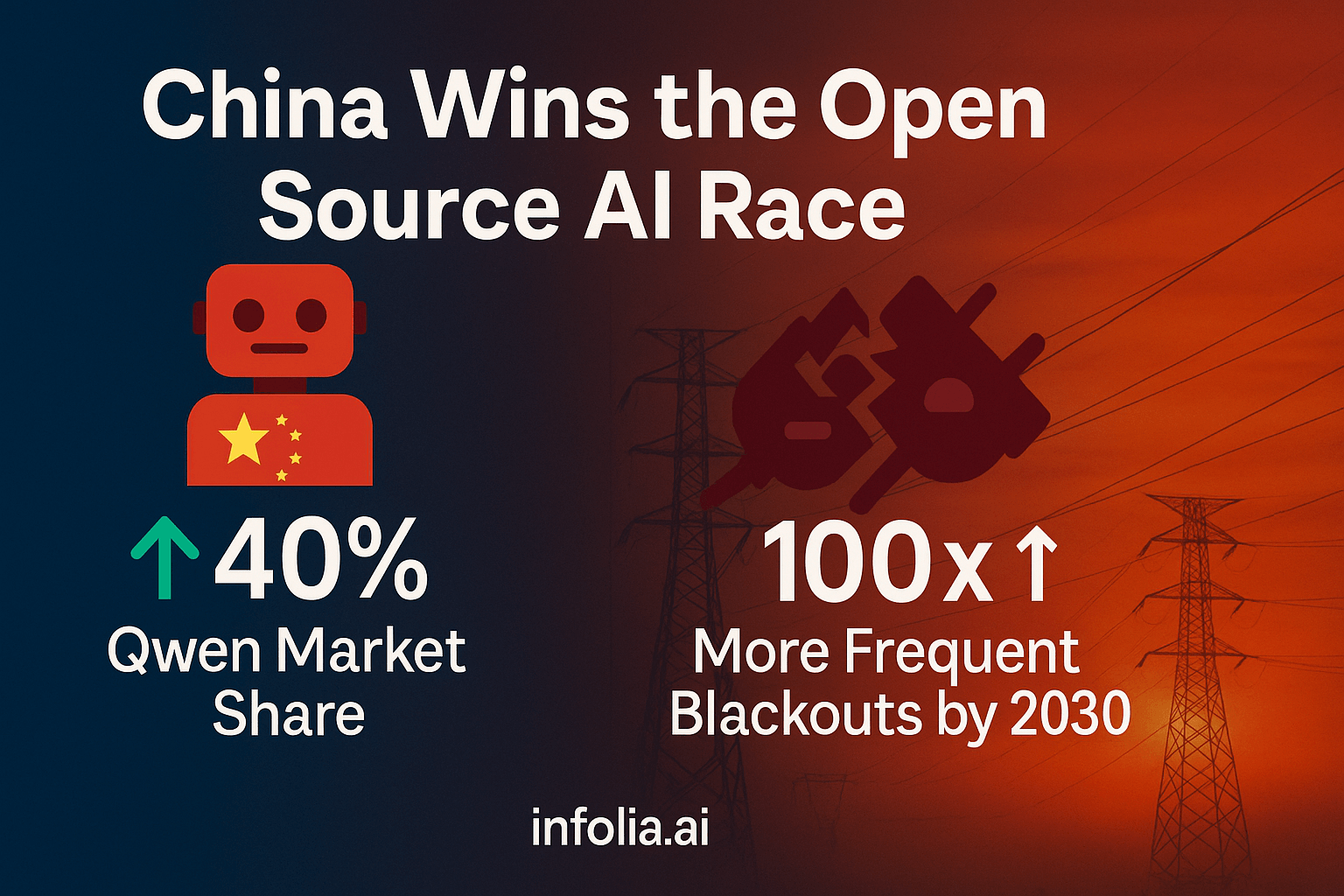

This week, a 313-page report confirmed what everyone's been whispering: China won the open source AI race. Qwen now powers 40% of all new AI models while Llama collapsed to 15%. Meanwhile, the real crisis isn't intelligence—it's electricity. Blackouts could hit 100x more often by 2030, and the AI boom might literally run out of power.

💥 China Wins the Open Source AI Race While America Faces a Power Crisis

On October 9, 2025, the State of AI Report dropped its 313-page analysis revealing a seismic shift: China's Qwen model now accounts for over 40% of new monthly model derivatives on Hugging Face, while Meta's Llama has crashed from 50% to just 15% market share. Nathan Benaich and Air Street Capital's eighth annual report confirms that Chinese lab DeepSeek is now "neck-and-neck with OpenAI and Google" at the reasoning frontier (State of AI Report, October 2025).

But the real story isn't who's winning the model race—it's the infrastructure crisis threatening to derail everything. The U.S. Department of Energy warns that blackouts could become 100x more frequent by 2030 due to AI demand, with a projected 68 GW electricity shortfall by 2028. Meanwhile, "NIMBYism" against new data centers has already blocked $64 billion in planned projects over environmental concerns (State of AI Report, October 2025).

The numbers reveal AI's transformation from software to physical infrastructure battle: $500 billion Stargate project aims to build 10GW of GPU capacity (4+ million chips), energy-rich nations are "grabbing their ticket to superintelligence," and paid AI adoption has exploded from 5% to 44% of US businesses in under two years. Average AI contract values jumped from $39,000 to $530,000, with projections hitting $1 million in 2026 (State of AI Report, October 2025).

Bottom line: The AI race is no longer about having the smartest model—it's about securing the power, water, and real estate to run it

🛠️ Tool Updates

Google DeepMind CodeMender - AI agent that automatically patches security vulnerabilities before exploitation

NVIDIA Vera Rubin Platform - Next-generation GPU platform powering $100B OpenAI partnership deployments

DeepSeek R1 - Chinese reasoning model matching OpenAI and Google performance

💰 Cost Watch

The trillion-dollar reality: OpenAI CEO Sam Altman expects to spend trillions of dollars on AI infrastructure, while leading AI-first companies generate $18.5 billion in annualized revenue. Power users now cost startups $50,000+ monthly for a single seat (State of AI Report, October 2025).

💡 Money-saving insight: Budget for infrastructure reality: Companies moving to AI-first operations should plan for 5-10x annual cost increases as usage expands. Average AI contract values hitting $530K means serious budget conversations with CFOs, not just engineering experiments.

🔧 Quick Wins

🔧 Diversify model dependencies: Strategy → Result → Time saved: With China's open models now essential (40% market share), test Qwen alongside proprietary models to reduce vendor lock-in. Qwen's permissive licenses make it ideal for production deployment without legal concerns—saves $10K+ monthly in API costs.

🎯 Security-first AI integration: Action → Benefit: Deploy automated security scanning like CodeMender's approach for all AI-generated code. With 45% of AI code failing security tests, treating AI output like junior developer submissions prevents production vulnerabilities before deployment.

⚡ Plan for power constraints: Forward-thinking move: If building AI infrastructure, factor in the projected 68GW power shortfall by 2028. Consider edge deployment, model quantization, and efficient architectures now—waiting until the crisis hits means competing for scarce data center capacity.

🌟 What's Trending

💰 Petrodollars Fuel AI Infrastructure

Middle Eastern sovereign wealth funds have become major growth financiers for AI labs, providing capital through non-voting, board-light deals that let startups raise at scale while retaining control. Energy-rich nations like UAE, Norway, and India are getting "OpenAI for Countries" franchises, effectively buying their ticket to superintelligence through massive data center investments.

This represents the collision of AI ambition and geopolitical resource competition—nations with energy surplus are converting it directly into AI compute capacity, while electricity-constrained regions face strategic disadvantage. Read more →

🛡️ Security Automation Emerges

Google DeepMind's CodeMender delivered 72 security fixes to open source projects in six months, using Gemini Deep Think to autonomously patch vulnerabilities in codebases up to 4.5 million lines. The system applies -fbounds-safety annotations that would have prevented past exploits like libwebp buffer overflows.

This shift from reactive to proactive security matters because AI-generated code creates vulnerabilities faster than humans can fix them. As offensive cyber capabilities double every five months, automated defensive tools become essential infrastructure rather than nice-to-have features. Read more →

💬 Are you preparing for the infrastructure crisis?

Have you factored power constraints into your AI strategy? Are you testing Chinese open models alongside proprietary options? How is your organization thinking about the shift from model quality to infrastructure access? Hit reply—I read every message and I'm curious how developers are navigating this transition from software to physical infrastructure competition.

— Pranay, INFOLIA AI

Missed Issue #24? Catch up here →

AI for Developers | Built for developers integrating AI, not researching it.